NO on EE

No on EE

Next Tuesday, October 8, 2024 at 4PM, the Santa Rosa City Council will have a second reading to adopt ballot Measure EE which would add a NEW BUSINESS TAX to all hosts in Santa Rosa who engage in Short Term Rentals. The ordinance documents can be found here.

We oppose this measure as it is written.

- Hosts in our city already pay hefty fees to operate, including a $1282 initial permit fee, and an ANNUAL RENEWAL FEE that is currently at $886. For some hosts, they are only sharing one or more bedrooms in their homes and these costs are already burdensome.

- For many hosts, this home sharing helps them afford to stay living in Sonoma County, afford much needed repairs and maintenance, and is a source of needed additional income.

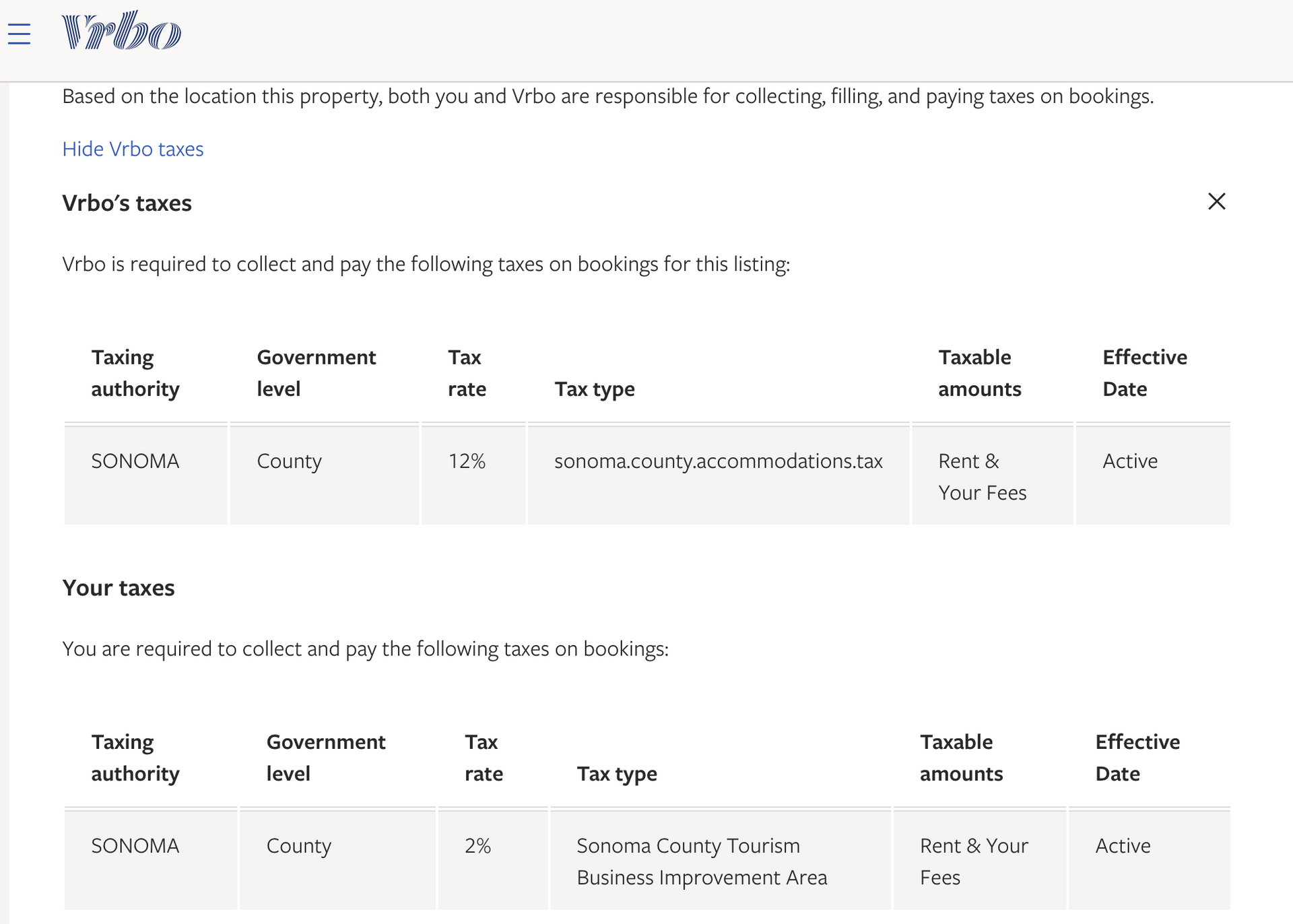

- The city is already attempting to raise TOT taxes by 2%, and with current BIA fees, that would make a total of 16% visitation taxes the most expensive in the county.

- With the addition of the business tax, and the increase in TOT, this will raise the cost of visiting Santa Rosa, and make our city less competitive than the surrounding areas.

- Not only do hosts lose in this equation, but any restaurant, winery, book store, gift shop, coffee shop and other small businesses that cater to people who visit our county, will see a decrease in revenue in our city.

- These taxes essentially send a signal to visitors to go elsewhere.

We need each host to email their Public Comment to the Santa Rosa City Council AND attend the meeting in person.

Email your comment to cc-comment@srcity.org by 5:00 p.m. the Monday before the City Council Meeting. Identify in the subject line of your e-mail, Agenda Item Number 13.2, and provide your name and comment in the body of the e-mail.

4PM Meeting Location:

Santa Rosa City Hall

Council Chamber

100 Santa Rosa Avenue

Santa Rosa, CA 95404

In the event a council member participates remotely, the city will also allow for Public Comment through the Zoom link or dial-in number below

ZOOM

HTTPS://SRCITY-ORG.ZOOM.US/J/89643446933, or by dialing or by dialing

877-853-5257 and entering WEBINAR ID: 896 4344 6933